Skip to main contentLuban pioneered preconfirmation technology before it was widely recognized. Our goal has always been to commoditize blockspace and improve price discovery for the most important digital resources of the future. The initial step involves implementing blockspace futures through Taiyi, which has emerged as the core value proposition of preconfirmation.

Futures contracts allow parties to buy or sell assets at predetermined prices for future delivery. In blockchain contexts, this concept enables the trading of future blockspace at set prices.

A primary application of futures is price lock-in. Physically delivered futures allow buyers to secure commodity costs, mitigating price volatility risks. Similarly, Taiyi preconfirmations enable users to lock in gas fees for future transactions, serving as an effective gas hedging tool.

For major gas consumers such as wallets, applications, and searchers, gas fee fluctuations have been problematic, leading to volatile costs and suboptimal user experiences. Gas fee hedging offers a solution, providing smoother user experiences and new profit opportunities.

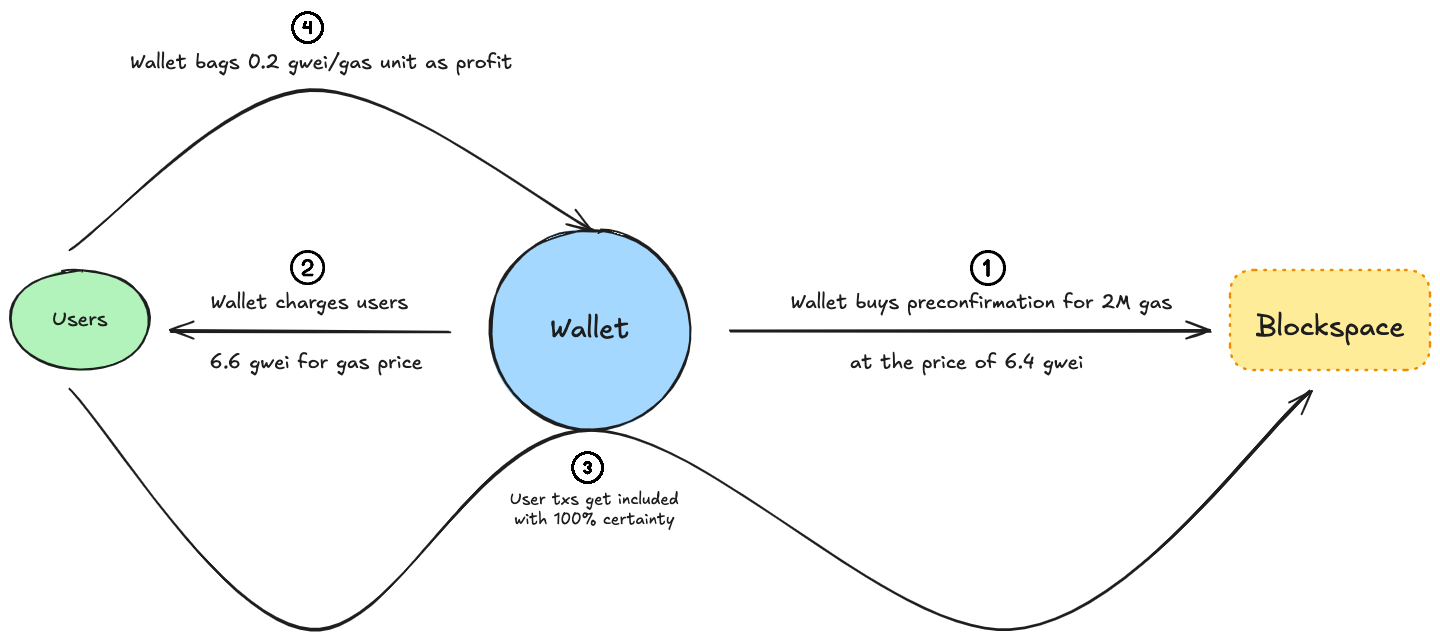

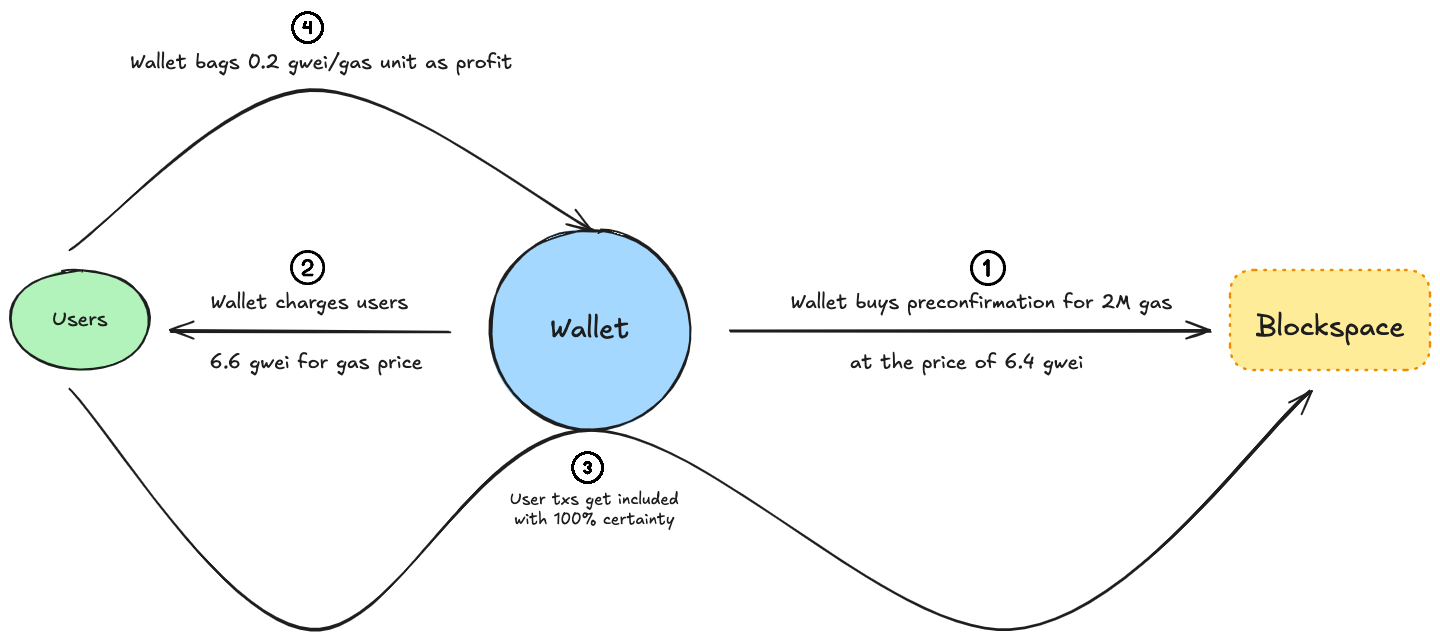

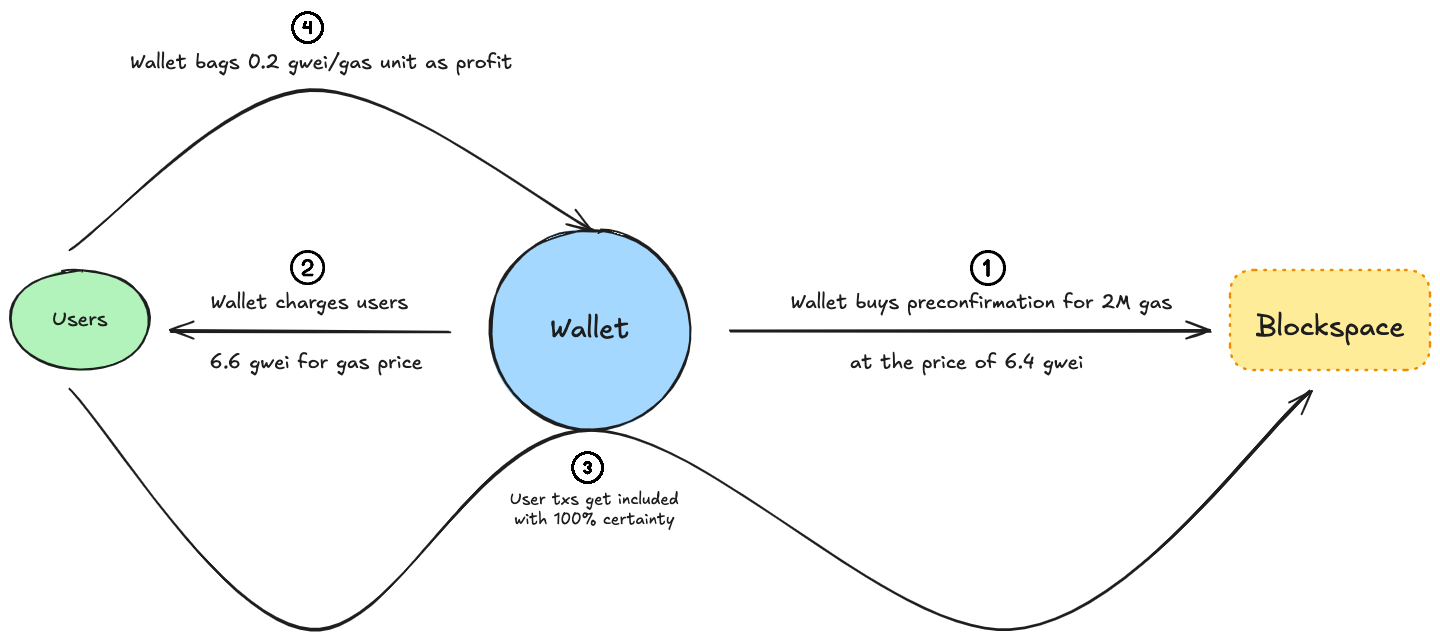

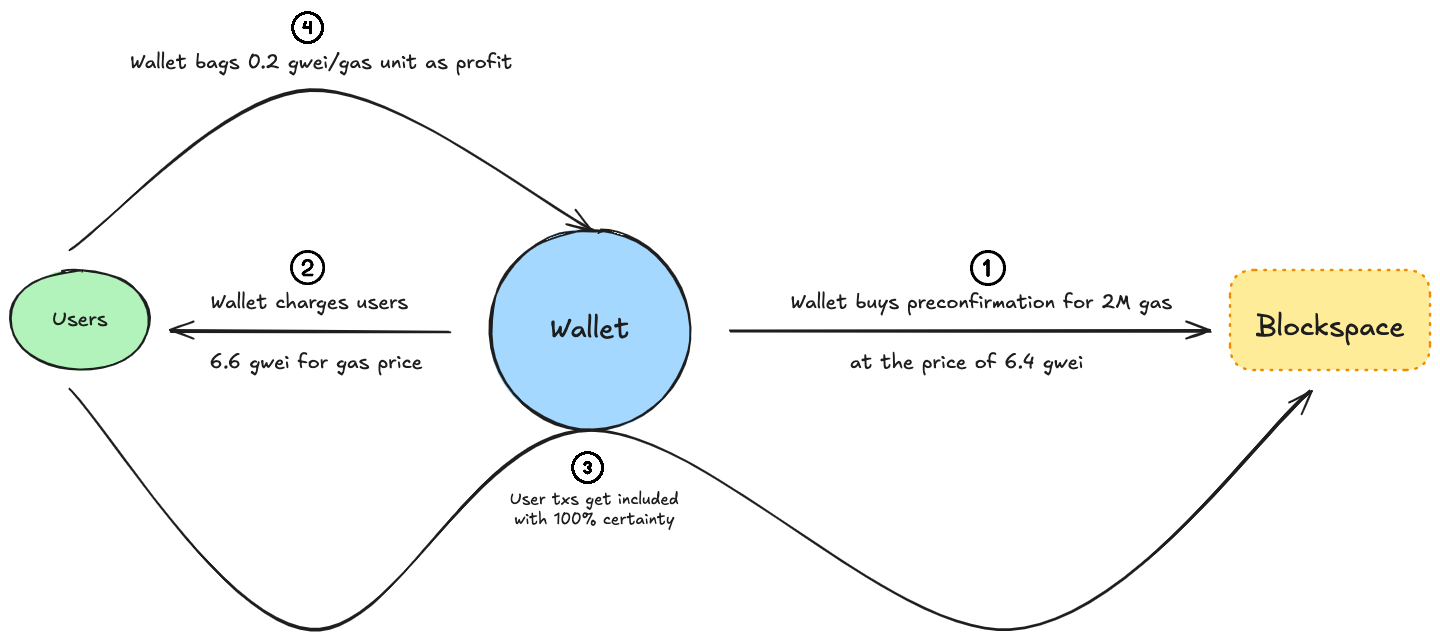

For example, wallets today are estimating gas fee in real time for every transaction, and dumping everything user pays on-chain. Due to the discrepancy between estimated and real gas fee, users either overpay for a transaction, or underpay, which leads to long waiting time, or even transaction revert. The wallets make no money in this process. With Taiyi, wallets can purchase future blockspace at predetermined prices, allowing them to offer users static gas fee quotes with guaranteed transaction inclusion. This approach also enables wallets to potentially profit by charging premiums on gas fees. Wallets can’t do it today because a premium that’s too big could make the transaction stuck for underpayment; with Taiyi, since the wallet already owns the blockspace, the premium can be determined freely without worrying about transaction failures.

A primary application of futures is price lock-in. Physically delivered futures allow buyers to secure commodity costs, mitigating price volatility risks. Similarly, Taiyi preconfirmations enable users to lock in gas fees for future transactions, serving as an effective gas hedging tool.

For major gas consumers such as wallets, applications, and searchers, gas fee fluctuations have been problematic, leading to volatile costs and suboptimal user experiences. Gas fee hedging offers a solution, providing smoother user experiences and new profit opportunities.

For example, wallets today are estimating gas fee in real time for every transaction, and dumping everything user pays on-chain. Due to the discrepancy between estimated and real gas fee, users either overpay for a transaction, or underpay, which leads to long waiting time, or even transaction revert. The wallets make no money in this process. With Taiyi, wallets can purchase future blockspace at predetermined prices, allowing them to offer users static gas fee quotes with guaranteed transaction inclusion. This approach also enables wallets to potentially profit by charging premiums on gas fees. Wallets can’t do it today because a premium that’s too big could make the transaction stuck for underpayment; with Taiyi, since the wallet already owns the blockspace, the premium can be determined freely without worrying about transaction failures.

Indeed, every blockspace consumer can use preconfirmation for gas hedging. It facilitates more sophisticated gas management and fostering a more efficient market for blockspace price discovery.

Indeed, every blockspace consumer can use preconfirmation for gas hedging. It facilitates more sophisticated gas management and fostering a more efficient market for blockspace price discovery.

A primary application of futures is price lock-in. Physically delivered futures allow buyers to secure commodity costs, mitigating price volatility risks. Similarly, Taiyi preconfirmations enable users to lock in gas fees for future transactions, serving as an effective gas hedging tool.

For major gas consumers such as wallets, applications, and searchers, gas fee fluctuations have been problematic, leading to volatile costs and suboptimal user experiences. Gas fee hedging offers a solution, providing smoother user experiences and new profit opportunities.

For example, wallets today are estimating gas fee in real time for every transaction, and dumping everything user pays on-chain. Due to the discrepancy between estimated and real gas fee, users either overpay for a transaction, or underpay, which leads to long waiting time, or even transaction revert. The wallets make no money in this process. With Taiyi, wallets can purchase future blockspace at predetermined prices, allowing them to offer users static gas fee quotes with guaranteed transaction inclusion. This approach also enables wallets to potentially profit by charging premiums on gas fees. Wallets can’t do it today because a premium that’s too big could make the transaction stuck for underpayment; with Taiyi, since the wallet already owns the blockspace, the premium can be determined freely without worrying about transaction failures.

A primary application of futures is price lock-in. Physically delivered futures allow buyers to secure commodity costs, mitigating price volatility risks. Similarly, Taiyi preconfirmations enable users to lock in gas fees for future transactions, serving as an effective gas hedging tool.

For major gas consumers such as wallets, applications, and searchers, gas fee fluctuations have been problematic, leading to volatile costs and suboptimal user experiences. Gas fee hedging offers a solution, providing smoother user experiences and new profit opportunities.

For example, wallets today are estimating gas fee in real time for every transaction, and dumping everything user pays on-chain. Due to the discrepancy between estimated and real gas fee, users either overpay for a transaction, or underpay, which leads to long waiting time, or even transaction revert. The wallets make no money in this process. With Taiyi, wallets can purchase future blockspace at predetermined prices, allowing them to offer users static gas fee quotes with guaranteed transaction inclusion. This approach also enables wallets to potentially profit by charging premiums on gas fees. Wallets can’t do it today because a premium that’s too big could make the transaction stuck for underpayment; with Taiyi, since the wallet already owns the blockspace, the premium can be determined freely without worrying about transaction failures.

Indeed, every blockspace consumer can use preconfirmation for gas hedging. It facilitates more sophisticated gas management and fostering a more efficient market for blockspace price discovery.

Indeed, every blockspace consumer can use preconfirmation for gas hedging. It facilitates more sophisticated gas management and fostering a more efficient market for blockspace price discovery.